When working in Korea, you might notice that the salary you receive is lower than your expected salary. For example, you were supposed to receive 2.4 million Korean won this month, but only 2.2 million Korean won was deposited. What gives? This difference is due to tax deductions and social insurance contributions. Understanding these systems is crucial for understanding your salary and maximizing your benefits before signing with a school.

1. Average Starting ESL Teaching Salaries in Korea

Salaries for teaching jobs in Korea differ based on the institution type and location. International schools typically offer starting salaries ranging from approximately 2.4 million to 2.7 million KRW per month (~$1,700 to $1,900 USD). Language academies usually start at around 2.4 million KRW (~$1,700 USD) per month, with experienced teachers able to negotiate salaries upwards of 3.0 million KRW (~$2,100 USD) or more.

Related Blog: Labor Rights for Native English Teachers in Korea

2. What Taxes are Paid by ESL Teachers in Korea?

As a native English teacher, you will pay income tax on your earnings. Your school withholds this tax each month and sends it to the Korean tax authorities. At the end of January each year, or when leaving Korea, you need to complete a year-end tax settlement to finalize your tax liability. You are eligible for the same income deductions and tax credits as Korean workers.

Tax Exception for EPIK Teachers

Some EPIK (public school) teachers from select countries are exempt from tax for the first two years in Korea due to tax treaties. Unfortunately, Canadian citizens are not exempt from taxes.

Tax-Exempt Countries (2 years):

- United States

- United Kingdom

- South Africa

- Australia

- Ireland

- New Zealand

|

Note: Teachers who worked their first year at a language academy and then transferred to a public school can claim only one year of tax exemption, while teachers who worked two years or more in Korea are not eligible. |

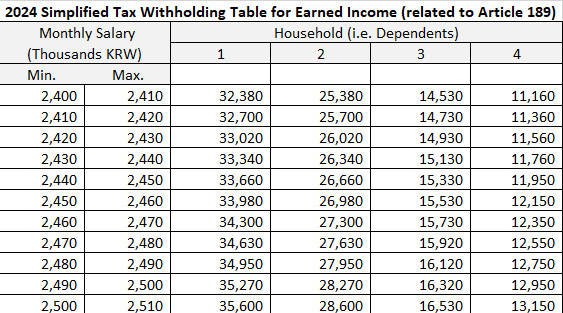

1. Monthly Withholding Tax (National Income Tax)

Each month, your school withholds an amount from your wage and salary based on the Simplified Tax Withholding Table (간이세액표) from the National Tax Service (NTS). Your school must remit the withheld tax to the tax office by the 10th of the following month.

The amount withheld depends on:

- Your monthly salary

- The number of dependents (e.g., spouse) and children under 20

- For example, if you earn 2,500,000 KRW (2.5 Mil.) per month and have no dependents, your national tax would be 35,600 KRW

| Note: A 3.3% withholding tax applies to freelancers and independent contractors. This arrangement is NOT permitted for E-2 visa holders. |

2. Monthly Local Tax

In addition to the national income tax, a local income tax equal to 10% of your national tax is also withheld from your wages, and your local tax would be 3,560 KRW.

Your total monthly tax would be 39,160 KRW (35,600 + 3,560), which deducted from your wage and salary, would be 2,460,840 KRW (~2.46 Mil.) before insurance contributions.

Source: Hometax (Mar. 2024)

Related article: 2025 Year-end Tax Settlement in Korea for Native English Teachers

3. Korea's 4 Major Social Insurances

Korea’s 4 major social insurances refer to four types of social security programs designed to protect and support workers in Korea. In Korea, schools must provide health, medical, and industrial accident compensation insurance.

1. National Pension: The National Pension System is a state-run social security system to help citizens maintain basic living standards by paying them monthly contributions while they earn income. Monthly pensions are paid when citizens can no longer earn a living due to old age, unexpected disabilities, or death (provided to the bereaved family in this case).

- Teacher contribution: 4.5% (monthly salary)

- School contribution: 4.5%

- Total Contribution: 9% (as of 2025, will begin to rise gradually by 0.5 percentage points each year, from 9 percent in 2025 to 13 percent in 2033.)

Eligibility for National Pension

Foreign residents in Korea aged 18–60 must subscribe to the National Pension Scheme, just like Korean citizens. An exception applies only if the person’s home country doesn't cover Korean nationals or offer a comparable pension system. Unfortunately, this excludes South Africa.

Lump-Sum Refund

Foreign subscribers are generally not eligible for a lump-sum refund. However, they may receive all contributions paid plus interest if they:

(1) returning to his/her home country

(2) has reached the retirement age required to receive pension payment (65 or older)

(3) has passed away (given to the bereaved family)

| Country | Pension Eligibility | Lump-Sum Refund Eligibility |

| United States | O | O |

| Canada | O | O |

| United Kingdom | O | Non-refundable |

| Ireland | O | Non-refundable/added to the native country pension |

| Australia | O | O |

| New Zealand | O | Non-refundable |

| South Africa | X | X |

2. Health Insurance & Long-term care Insurance: Korea's National Health Insurance (NHI) plan covers essential medical expenses, health checks, and general healthcare costs.

- Teacher contribution: 3.545% (monthly salary)

- School contribution: 3.545%

- Total Contribution: 7.09%

Once you register for your Residence Card (formerly ARC), you'll be automatically subscribed to Korea’s National Health Insurance.

An NHI Card and Subscription Guide will be sent to your residential address in Korea. You'll have the same benefits as the Korean citizens, including dental treatment, free bi-annual general health checkups, and pregnancy and childbirth-related support for medical expenses.

Be sure to ask your school if the insurance covers international hospitals as well as local hospitals. This is a mandatory subscription.

3. Employment Insurance: Employment or unemployment insurance provides unemployment benefits if you lose your job. Native English teachers on E-2 visas and F-4 (Overseas Korean) visa holders are not required to enroll in Employment Insurance if they choose not to. However, holders of F-2, F-5, and F-6 visas are obligated to participate.

- Teacher contribution: 0.9% (monthly salary)

- School contribution (under 150 workers): 0.9%

- Total Contribution: 1.8%

Employment Benefits

Benefits are provided to newly unemployed workers seeking new employment, provided certain conditions are met.

Eligible teachers must:

-

Have been forced to resign for “just cause” (not voluntarily resigning or being dismissed for “just cause”), and

-

Have worked at least 180 insured days within the 18 months at a workplace covered by employment insurance

4. Industrial Accident Compensation Insurance: Workers’ compensation or industrial insurance covers medical expenses and compensation for injuries or illnesses that occur as a result of work. The insurance premium depends on the size and payroll of the school. For educational services, the standard rate is 6 per 1,000 of total payroll (i.e., 0.6%).

- School contribution: Paid entirely

Total: ~9.39% of your monthly salary

4. How to Calculate Your Monthly Income After Taxes and Insurance Contributions

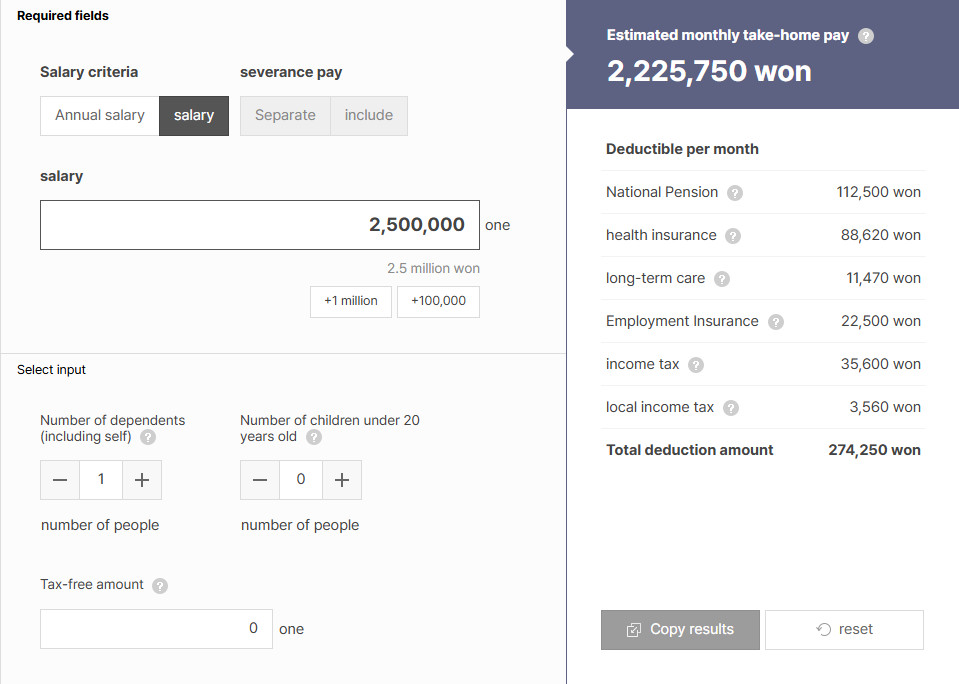

To quickly estimate your monthly take-home pay after taxes and insurance contributions, you can use an online calculator like the Saramin Salary Calculator (www.saramin.co.kr/zf_user/tools/salary-calculator).

|

The results from this calculator are estimates only and may differ from the actual figures. |

1. Visit the Saramin Salary Calculator page. Turn on the Google Translate option.

2. Under salary criteria ("급여 기준"), click monthly salary ("월급").

3. Type your monthly salary ( "월급") and press Enter. The calculator will display your estimated monthly take-home pay ("월 예상 실수령액").

Example:

- Monthly salary: 2,500,000 KRW (2.5 million Korean won).

- Total deductions (income tax + social insurance contributions): 248,350 KRW

- Estimated take-home pay: 2,251,650 KRW (2.25 million Korean won)

| Note: "Long-term Care" (장기요양보험) is insurance available to individuals aged 65 or older, or to those under 65 who have age-related conditions such as dementia or stroke (not applicable to teachers). |

Source: Saramin

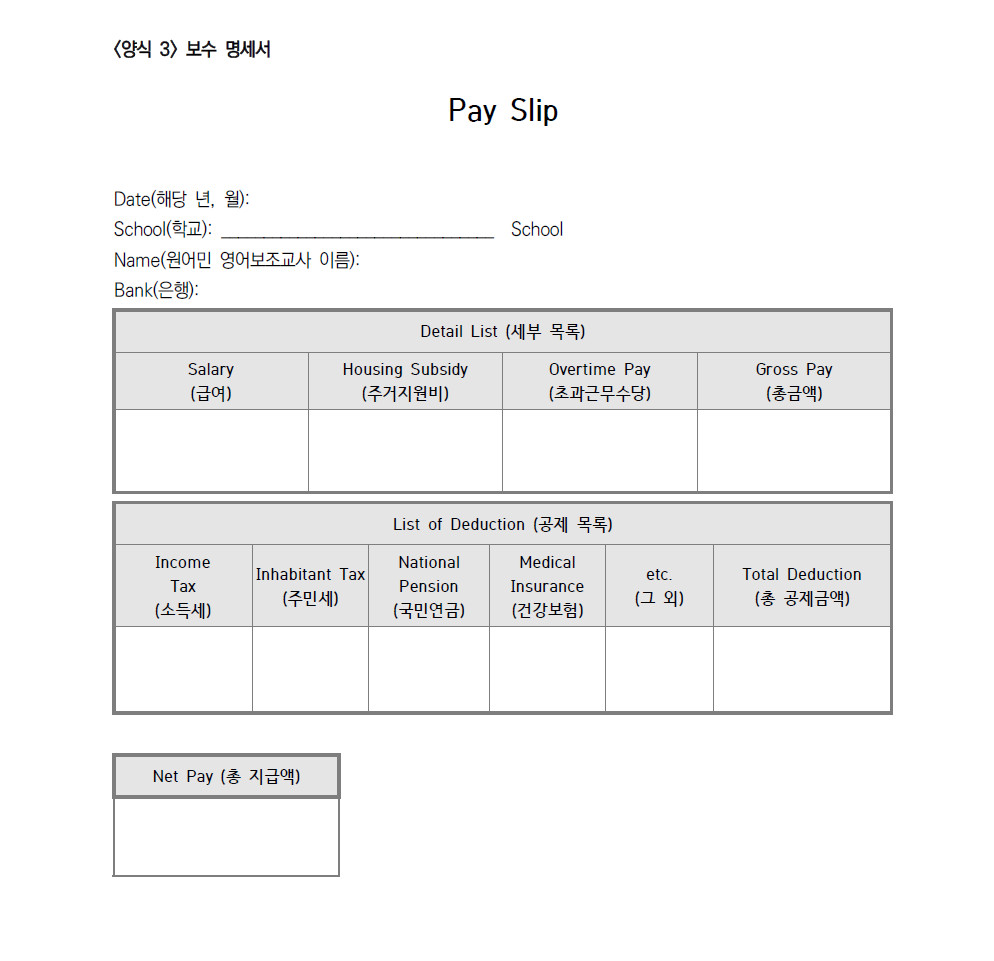

5. Review Your Pay Slip Each Month

On your designated monthly payment date, you will receive a pay slip detailing your deductions and showing your total net pay. We recommend reviewing it carefully to understand the exact breakdown of taxes and social insurance contributions. If your pay differs significantly from the estimates, please consult your school.

Source: Busan Metropolitan Office of Education (2024)

Source: Busan Metropolitan Office of Education (2024)Share

Embark Recruiting Blogs

Embark Recruiting

As former native English teachers in Korea, we know exactly what it’s like to navigate teaching abroad. That’s why we’re committed to increasing transparency in schools and improving Korea’s ESL teaching industry. At Embark Recruiting, we provide full support to help you succeed. Our blogs offer guidance, tips, and insider knowledge for teaching in Korea.